Terms and conditions of compulsory insurance

The compulsory insurance is formulated for the benefit of the three parties of the policyholder.

Only compensate each other.

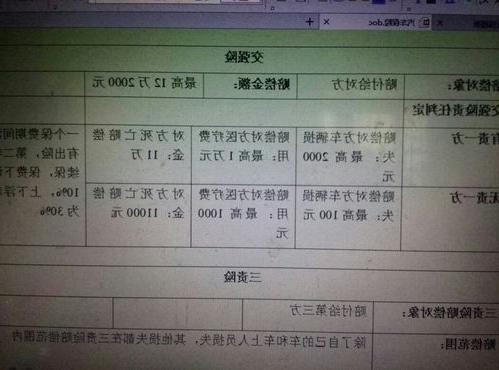

Liability limits two thousand for property damage ten thousand for medical treatment of personal injuries and one hundred and eleven thousand for death and disability. Limit of liability.

Vehicle transfer compulsory insurance how to do

Every car needs to buy compulsory insurance, then in the vehicle transfer about compulsory insurance should do? This is the transfer of both sides need to understand the problem, you need to understand through this article, after all, compulsory insurance for car owners is very important insurance, the following I organized the following content for you to answer, I hope to help you!

Vehicle transfer compulsory insurance how to do

Every car needs to buy compulsory insurance, then in the vehicle transfer about compulsory insurance should do? This is the transfer of both sides need to understand the problem, you need to understand through this article, after all, compulsory insurance for car owners is very important insurance, the following I organized the following content for you to answer, I hope to help you.

First, the vehicle transfer compulsory insurance how to do

After completing the vehicle transfer process at the DMV, it's a good idea to go to your insurance company in a timely manner.

Step 1: You need to go to the DMV to transfer your vehicle.

The second step, with the compulsory insurance change procedures: your transfer is completed after the driving license, used car trading invoice, compulsory insurance policy, the original compulsory insurance policyholder insured ID card, and the new owner's ID card, to the insured insurance company to request the transfer.

The third step, the insurance company will be free for you to do the approval process, and to play a batch of sheets, written on them similar to the text: due to the vehicle transfer, my insurance company agreed to XXX (do the approval of the next day) policy number for the XXX policy, the insured by XXX change to XXX, license plate number from XXX change to XXX, license plate owner from XXX change to XXX, other matters remain unchanged, hereby approve the change. The other matters remain unchanged and are hereby approved.

Step 4: The change is complete, the new owner takes the endorsement and the original policy, and the transfer is complete.

Second, the scope of exemption from compensation for compulsory insurance

According to the relevant laws of China, the insurance company will not be liable for compensation in the following cases within the limit of liability of compulsory traffic insurance:

1, the victim's intentional behavior caused by traffic accidents personal injury, property damage, such as: suicide, self-inflicted injuries, bumper stickers and so on.

2. Personnel of the insured vehicle and the insured as specified in paragraph 3 of the Regulations on Compulsory Insurance for Traffic Accident Liability; and

3. Arbitration or litigation fees and other costs related to the traffic accident.

4. Indirect losses, e.g., diminution in value of vehicles due to collision.

Therefore, when the vehicle transfer compulsory insurance is also required to carry out the transfer procedures, you have to follow the above way to deal with, so as to comply with the provisions of the law. With compulsory insurance in order to make the vehicle to get insurance protection, for new car owners is also a need to pay attention to the problem. If you have other questions, welcome to consult a professional.

How to handle vehicle transfer disputes

We know that the vehicle transfer is to handle the relevant procedures, but many times the vehicle transfer there are certain disputes, then if there are these problems should be how to deal with it? Below I explain the content for you, for your reference and study, I hope for you to help.

First, how to deal with vehicle transfer disputes

1. Negotiated settlement

If a dispute arises between the parties to a contract in the course of its performance, it should first be resolved in accordance with the principles of equality and mutual benefit and consensus. Neither should they resort to passive procrastination, nor should they exercise their own legal dispositions by withholding the goods or refusing to pay for them, since neither of these two approaches is conducive to the resolution of the problem. According to the law, disputes should first be resolved through consultation. Since the settlement of disputes through consultation is based on mutual understanding and mutual accommodation and equal consultation between the two parties, it does not affect solidarity and continued cooperation in the future, and saves time, manpower and costs, this method should be used more often.

2. Arbitration settlement

Arbitration refers to the dispute between the two parties to a contract, consultation fails, according to the relevant provisions or the agreement between the parties, a certain institution in the capacity of an intermediary or a third party, the dispute between the two parties, in fact, to make a judgment, in terms of the rights and obligations of the decision. The use of arbitration to resolve contractual disputes is a commonly used method.

The parties should pay attention to the following issues when using arbitration to resolve contractual disputes:

(i) Deadline for arbitration. The parties must seize the opportunity to exercise their rights in a timely manner within the validity period of the application for arbitration provided for by the law, so as to avoid losing their right to apply for arbitration due to missing the opportunity.

(ii) Arbitration organ and jurisdiction. According to the provisions of the Contract Arbitration Regulations, the contract arbitration organs are the State Administration for Industry and Commerce and the contract arbitration committees established by the local administrations for industry and commerce at all levels. The principle of jurisdiction of the case is that it is generally under the jurisdiction of the arbitration organ at the place of performance of the contract or the place where the contract was signed. Therefore, the parties should apply for arbitration to the arbitration organ with jurisdiction.

(c) Arbitration effect. After both parties reach an agreement through conciliation by the arbitration authority, the agreement has legal effect and both parties must comply with it in good faith. If the conciliation fails, the final arbitral award made by the arbitration body will have legal effect and must be complied with by the parties; otherwise, it will be enforced by the court.

Second, used car transfer procedures

Seller: the owner's ID card, vehicle registration certificate, vehicle traveling book, the original invoice for the purchase of the car (if the previous transfer is a transfer ticket).

If the seller is a unit, the original organization code certificate and official seal are required.

Buyer: ID card, outsiders on the local license plate another valid temporary residence permit. (Some cities have changed to use the residence permit, which can be linked to the public security network!)

If the buyer is a unit, the original organization code certificate and official seal are required. Original vehicle license. Vehicle registration certificate (big green book).

Outbound relocation requires a small purchase tax book (small red book before 2001 small green book after 2001). (Needed before 2012, after 2012 the vast majority of cities do not need. Unless the autonomous region, it is not necessarily), with all the above procedures, to the used car transfer hall.

Both parties: sign the contract of sale and purchase of used cars with all the above formalities, to the used car transfer hall.

Through the above explanation, we can understand is the vehicle transfer disputes can be negotiated, the transfer of relevant information must be ready. These are the relevant content I have organized for you, if there are still questions or further requirements, you can consult the relevant.

What to do when you transfer your vehicle for compulsory insurance @2019

What types of car insurance do you typically buy?

There are a dozen types of car insurance, and the only way to get the right car insurance is to get the right one for you.

Many people who buy a car are overwhelmed with the knowledge of how to buy car insurance.

Many times, are listening to the sales staff fooled buy a pass, do not know that every year in vain to waste a large amount of money.

Today, the schoolmarm is here to nag you about buying car insurance, and if you want to know how to get a good deal on a year's worth of car insurance, click on the article below to reveal it:

Focus of this article:- Which car insurance policies are a must?

- Which car insurance policies are on demand?

- Configuration options for automobile insurance

A. Which car insurance is a must-buy? 1. compulsory insurance

Compulsory insurance is a state-mandated insurance that every car owner must purchase to protect the third-party victims of traffic accidents from personal injury and property damage. This is the most basic coverage of auto insurance, similar to social security, and is designed to avoid the situation where some car owners are insolvent in the event of a traffic accident.

If you don't buy compulsory insurance, the car can't be driven on the road, and having a car is equivalent to not having a car. If you are caught by the traffic police, you will have to impound the car, and you will also be fined double the premiums, and you won't be able to return the vehicle until the insurance is completed.

Although the premium for the first year of compulsory insurance is fixed and standardized by the state, the premium for compulsory insurance for private cars with less than 6 seats is RMB 950, and the premium for private cars with more than 6 seats is RMB 1,100. The premium for the second year is adjusted according to whether or not a culpable traffic accident occurred in the previous year.

I've organized the specific premium adjustments as well as the limits of indemnity, claims process, and other related information in this article:

2. Third party liability insurance

Like compulsory insurance, third party liability insurance covers the third party victims for personal injuries and property damage caused by road traffic accidents.

But the traffic insurance maximum payout of 122,000, for the occurrence of serious traffic accidents, resulting in serious damage to the other vehicle, casualties, or hit a luxury car, the traffic insurance alone that a little bit of money is far from enough, the need for third-party liability insurance to carry out the amount of coverage to supplement.

In general, it is recommended that car owners buy 1 million dollars of coverage, the economic conditions are really limited car owners also buy at least 500,000 dollars of coverage, the economic conditions allow car owners can buy more than 1 million dollars of coverage. Because the current individual death compensation in the 700,000 or so. If the luxury car is seriously damaged, 500,000 is not enough to compensate, so you must ensure that the third party liability insurance coverage should be sufficient.

What is the premium for third party liability insurance? Can I get full compensation if I buy it? The answer is here:

3. Car damage insurance

Car damage insurance is responsible for paying for damage to your own car, not the other person's vehicle. For example, the insurance company will pay up to the limit of liability when the vehicle is damaged by collision, overturning, fire, explosion, or by falling or collapsing objects from outside, as well as when it is damaged by a collision with someone else's vehicle, resulting in damage to your own vehicle.

In the event of a traffic accident, if the other party is fully responsible, the other party will be fully responsible for the repair costs of the vehicle, medical expenses, lost wages, nursing care, transportation costs, nutritional expenses, etc. However, if the other party is not fully responsible, you need to pay part of the repair cost of the vehicle yourself. If you have bought car damage insurance, then the repair cost of the vehicle will be borne by the insurance company.

Moreover, the vehicle traveling on the road bump is very normal, if you change what parts need to spend a lot of money, serious traffic accidents, the cost of repairs far more than the premium, so buy car insurance is also to "small premiums, prying large amount of coverage.

As for the premium of car damage insurance, the amount of car damage insurance compensation and other issues, I will not go into details here, please read the details:

4. Non-deductible insurance

Deductible insurance is an additional insurance for commercial car insurance, deductible is "no compensation", that is, the part that requires the owner to pay out of pocket, in traffic accidents, according to the owner's responsibility, the insurance company will give the corresponding deductible rate: negative full responsibility deductible 20%, negative primary responsibility deductible 15%, negative same responsibility deductible 10%, negative secondary responsibility deductible 5%. The insurance company will offer the following deductibles: 20% for full responsibility, 15% for primary responsibility, 10% for co-responsibility, 5% for secondary responsibility.

If you don't buy deductible insurance, the portion of the deductible in the event of an accident is at the owner's expense. If you have a serious traffic accident and have to compensate the victim for 1 million dollars, but because you are fully responsible, you have a 20% deductible, leaving you with the remaining 200,000 at your own expense. If you buy deductible insurance, this part of the money is borne by the insurance company for you, do not need to pay out of their own money, of course, if it exceeds the insured amount is also to pay out of their own money.

So how much does deductible insurance cost? Will you get full coverage if you buy it? This article tells you the answer:

Second, which car insurance is purchased on demand? Vehicle Personnel Liability Insurance: pays for injuries or deaths of people in this vehicle in the event of an accident. If you are a novice, online car driver or someone who often drives friends out, it is recommended to purchase it for better protection of the people in the car.

Total car theft insurance: It is responsible for paying for the loss of the whole car caused by theft, robbery and snatching. You can buy it if you have no fixed garage, often drive on business trips, or are in an area with poor security and often park in open parking lots.

Spontaneous combustion insurance: It is responsible for paying for the loss of the insured vehicle due to the problems of the electric circuit, line, oil circuit, fuel supply system, cargo itself, and the fire caused by the friction of the motor vehicle operation, which results in the loss of the insured vehicle. Generally speaking, new cars do not need to buy, because the parts are new, the possibility of spontaneous combustion is very low, and the new car warranty period, if spontaneous combustion occurs directly to the business. But if it is more than 5 years old car or often run long distance car is very necessary to buy.

Water-related insurance: it pays for water in the engine while the vehicle is traveling. It can be purchased if you are in areas of heavy rainfall, flooding, and poor urban drainage.

Scratch insurance: The insurance company will pay for the damage of body scratches without obvious signs of collision in accordance with the terms and conditions. If your car is often parked in the open, the neighborhood bears a lot of children can buy.

Glass breakage insurance: If the windshield or window glass is broken separately, the insurance company will compensate according to the actual loss. If you often take the highway, easy to be flying stone broken glass; or often parked in the open parking lot, parking area security is not good if you can buy.

In addition to these types of insurance, there are some additional insurance policies that you can purchase depending on your situation:

Third, the configuration of the car insurance program car insurance configuration program is not fixed, the following configuration program can be used as a reference, the specific purchase can be adjusted according to their own actual situation, but according to the big data show that most of the car owners choose the following three kinds of car insurance program:

◆◆ Affordable: compulsory insurance + three persons insurance + car damage insurance + deductible insurance

It is suitable for vehicle owners who have been using their vehicles for a long time, are skilled drivers, are less likely to be involved in traffic accidents and are willing to take most of the risks themselves.

◆◆ Regular practical type: traffic force insurance + car damage insurance + three persons insurance + vehicle liability insurance + deductible insurance

It is suitable for parking lots or garages that are guarded for a long period of time, as well as for car owners who have a certain amount of driving experience, online car drivers, often drive their friends out and are willing to take some of the risks themselves.

◆◆ Comprehensive protection type: traffic force insurance + car damage insurance + three persons insurance + vehicle liability insurance + theft insurance + glass breakage insurance + deductible insurance + scratch insurance

Ideal for new car owners or those who want comprehensive coverage.

Once car owners know which car insurance policies they are going to buy, they should also focus on which car insurance company they are going to insure their car with, and this is a list of car insurance policies that you should take a look at:

Want to buy a good insurance, just read this article is not enough! If you still can not pinpoint their own situation, the configuration of the insurance doubts, you can find a sister for detailed consultation - attention [school bully said insurance] public number , which has all kinds of insurance knowledge, the latest insurance product introduction, to help you buy insurance is not pit!

Write in the end I'm Scholars Speak Insurance - Waner, focusing on objective, professional and neutral insurance reviews;

Buying insurance is never easy.

If the above hasn't solved your problem, you can still come to me for help;

I will give you the most professional advice with years of experience in configuring insurance for 10W+ families.

? Public No.: [Scholar said insurance] Spend less money, buy the right insurance!

Extended reading:>> Which is the best earth car insurance?

>>What's the best auto insurance?

>> Is AXA Tianping car insurance good?

>>Is glass insurance necessary in car insurance?

>>What is the best way to buy auto insurance?

>>Peace of mind car insurance everyone contacted? I don't know if it's reliable.

>> Has anyone bought car insurance online like paypal?

>>How to pay for water-related insurance, seek coverage and process?

>>New car only bought the compulsory insurance, now out of the insurance can still buy commercial insurance?

>>Is it necessary to have glass, tire, and water insurance on your commercial auto insurance?

>>136 critical illness insurance comparison assessment of the whole network, a look through the critical illness insurance cats and dogs

>>Super Complete! Comparison Table of Popular Domestic Million Dollar Medical Insurance

>>Which accident insurance to buy? Just look at this comparison table!

>>2020 Latest China Life - Guoshoufu Assessment Report

>>2020 Latest Pacific-Golden Blessing Life Assessment Report

>>2020 Latest Pacific Life - Insurance Company Assessment Report

>>The Latest Hong Kong Insurance Company Rankings in 2020

>>Ranking the latest cost-effective kids insurance in 2020

>>Top 10 Cost-Effective Senior Insurance for 2020

>>Top 10 Best Small Medical Insurance Recommendations for 2020